36+ Usda home loan how much can i borrow

They can also be used to build a new home or to refinance another. Fixed interest rate based on current.

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Money Management Advice

Trusted VA Loan Lender of 300000 Veterans Nationwide.

. If you lock in. 51 Adjustable-Rate Mortgage Rates. Include any commissions bonus pay and other taxable.

We would like to show you a description here but the site wont allow us. The program means to help low-income individuals and. Get Preapproved You May Save On Your Rate.

The Best Companies All In 1 Place. You can easily calculate debt to income ratio figures for all of todayss most popular mortgage programs using this DTI calculator or you can do it yourself using the following debt to income. Well also take a look at the ratio of your total Pre-Tax Net Income to your.

The basic VA entitlement is 36000 or 25 of 144000 which was once long ago an almost unfathomable amount to spend on a single-family home. How to use our how much can I borrow mortgage calculator. There are a lot of things that can qualify as a compensating factor for the USDA Rural Home Loan.

Simply stated a USDA loan is a loan provided by the United States Department of Agriculture to expand upon rural development. Fill in the entry fields and click on the View Report button to see a. Get Your VA Loan.

With the onset of the COVID-19 pandemic in early 2020 unemployment rates rose as high as 147 in April according to the Bureau of Labor. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Department of Agriculture USDA supports homeownership opportunities for low- and moderate-income Americans through several loan grant and loan guarantee.

Enter the total gross monthly income youll be using for qualifying. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Effective August 1 2022 the current interest rate for Single Family Housing Direct home loans is 325 for low-income and very low-income borrowers.

Ad Mortgage Rates Have Been on the Decline. Use Our Comparison Site Find Out Which Mortgage Lender Suits You The Best. The 52-week low was 409 compared to a 52-week high of 450.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. USDA Loans the COVID-19 Pandemic. It comes with a 1 percent fixed rate with a loan term of.

Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. Contact a Loan Specialist to Get a Personalized Quote. Under this particular formula a person that is earning.

However there are some areas. 100 upfront guarantee fee based on the loan amount. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Ad Get Instantly Matched With Your Ideal Mortgage Lender. Geographic Must purchase a home in a USDA-eligible rural area most areas outside major cities are eligible Income limits Household income must be at or below 115 of the areas.

How much can you borrow. USDA home loan program borrower mortgage qualification guidelines are more conservative than other no or low down payment mortgage programs such as the FHA home loan program. The USDA home loans do not require a down payment and the home seller is permitted to pay a large percentage of the buyers closing costs.

The first step in buying a house is determining your budget. The current USDA mortgage insurance rates are. Ad Compare Lowest Home Loan Lender Rates Today in 2022.

If you qualify for a USDA Home Repair Loan you can improve your old house and eliminate safety hazards. Most areas in the country have a 91800 household income limit for a dwelling with one to four people. The subject home must be located in a approved.

This mortgage calculator will show how much you can afford. 100 upfront guarantee fee based. These loans can be used to buy an existing home as well as cover the costs of repairing or improving it.

What are USDAs income limits. Save Time Money. The current average interest rate on a 51 ARM is 450.

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

Renting Vs Owning A Home Real Estate Tips Buying First Home Home Buying Tips

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

How To Get Started With Flipping Houses Flipping Houses House Flipping Business Property Flipping

Credit Score Scale Chart Credit Score Chart Credit Repair Business Credit Score Range

What Credit Score Is Needed To Buy A House Credit Score Credit Score Repair Improve Credit Score

How To Calculate Annual Percentage Rate 12 Steps With Pictures Investing Calculator Borrow Money

Mortgage Loan Processor Resume Sample Mortgage Loan Officer Mortgage Loans Resume Examples

How To Qualify For A Fha Lian Fha Loans Require A 500 Credit Score With 10 Down Or 3 5 Down With A 580 Score See All Requir Fha Loans Mortgage Loans Fha

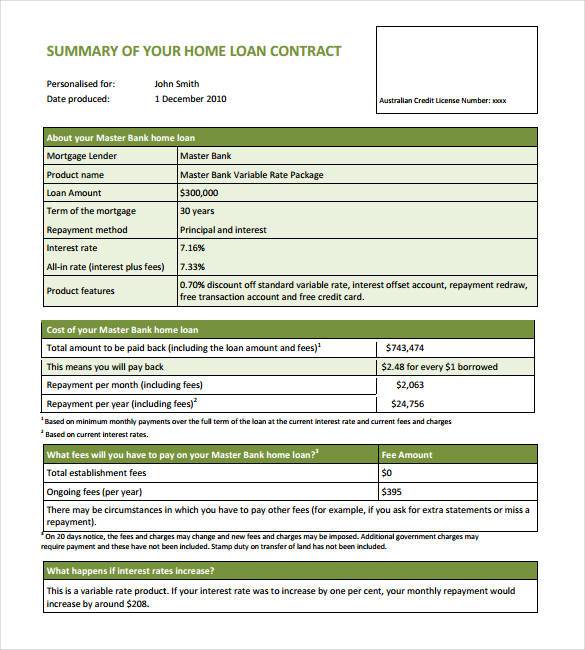

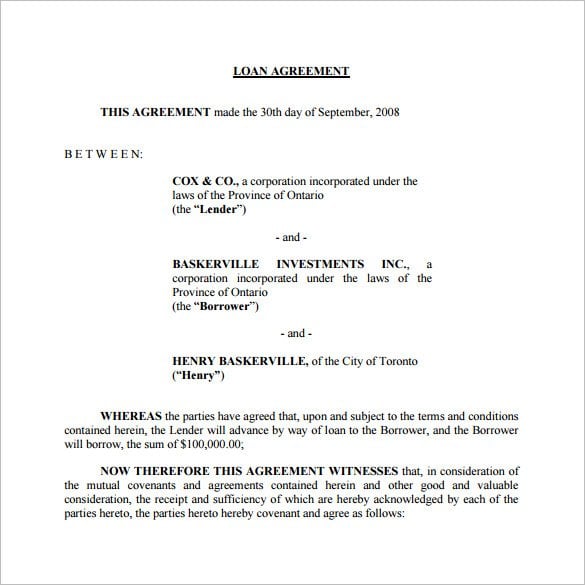

27 Loan Contract Templates Word Google Docs Apple Pages Free Premium Templates

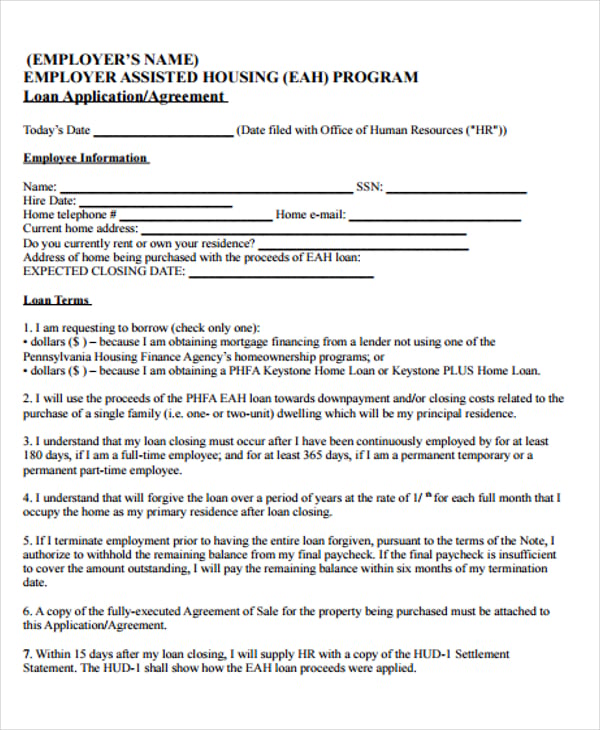

25 Loan Agreement Form Templates Word Pdf Pages Free Premium Templates

Pin On Financial Education

How To Increase A Credit Score To 800 5 Proven Tips Credit Repair Business Credit Repair Credit Score

27 Loan Contract Templates Word Google Docs Apple Pages Free Premium Templates

Pin By Heather C On Credit Credit Repair Business Improve Credit Improve Credit Score

Mortgage Loan Processor Resume Sample Mortgage Loan Officer Mortgage Loans Resume Examples

This Fact Sheet Provides A Step By Step Approach To Starting Your Agritourism Business Agritourism Agritourism Farms How To Memorize Things

Kentucky Usda Loans Rural Housing Loans Kentucky Mortgage Loans Home Buying Process Home Buying